CBA Financial Wellbeing

CommBank is Australia's largest bank and has progressed to be at the forefront of user centred design internationally.

It was a privilege to lead the team working help the wellbeing of millions of people.

"Dean puts the customer at the heart of every experience he designs"

Sophie Orchard

- UX / CX Writer at CommBank

My Role

Dean was UX Design lead on initiatives including:

Financial wellbeing strategy (contributor)

Savings goal feature

Spend tracker feature

Financial wellbeing health checks online and in branch

Financial hardship support (contact centre)

Strategic project to reimagine the banks services and value proposition after partnering with insurance company AIA

Objectives

The bank also sought to improve the financial wellbeing of customers, particularly in light of greater regulatory scrutiny. During this time the bank defined financial wellbeing measures. Our role was to make a positive impact in these areas including objective and subjective measures.

Results

Financial wellbeing

Dean helped many customers set goals and save to build financial resilience, manage spending and engage in financial health checks.

The projects had a significant positive effect on brand perception and was indirectly attributed to significant uplift in acquisition.

Vision

• The vision of these projects was to engage customers in ways that positively changed behaviour and financial outcomes.

• We worked on a players journey to help people understand the basics of each level of financial capability and then 'level up' to higher levels.

• We implemented many approaches as part of the strategy to build financial capability including 1) informing 2) intervening and 3) automating actions to help customers.

The story in images

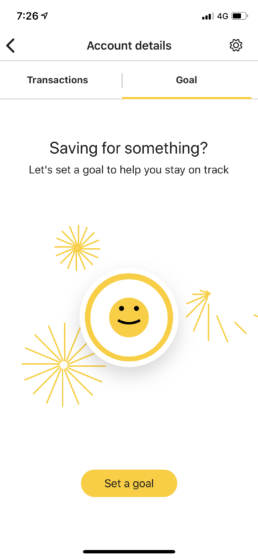

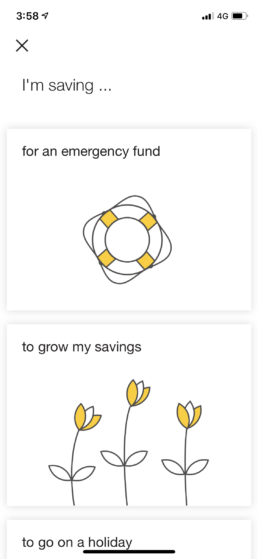

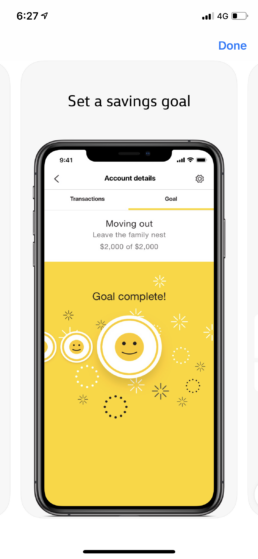

Goals Feature in the CommBank app

We ran a design sprint bringing together people from the business, data science, solution architecture, customer facing staff and UX design to quickly conceptualise concepts focusing on key customer needs.

We ran user needs analysis interviews along with testing various concepts to identify what would be the most helpful, engaging and user friendly design.

Savings goal feature engages customers to set up a goal (overcoming the intention action gap).

Beautiful animations were added using Lottie to motivate the user to select goals.

Goals focusing on building financial resilience were positioned at the top, followed by the most common goals such as travel, house deposit etc. Goals were identified based on past customer goal data.

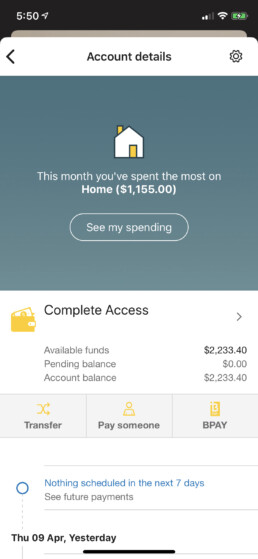

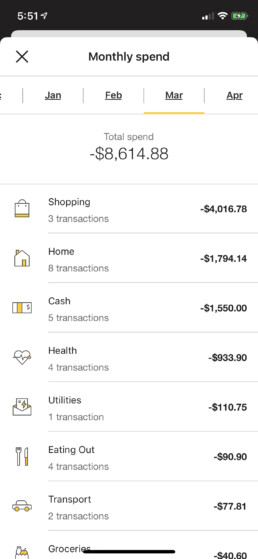

Spend Tracker Feature (This heading needs to move down to be above the image below)

Customers received a celebration when they achieved a goal.

We refined the Spend tracker so users could see their top spend category on the accounts main page.

This was part of an experiment to explore the types of interventions to effectively drive more informed spending behaviour to build financial resilience and reduce financial stress.

These screens are some of the most visited in among the bank’s 9 million customers, providing a valuable place to test, learn and scale approaches that customers find most helpful.

The work of our team enabled customers to categorise spending once and have all future transactions with a vendor be categorised in the same way. This reduced wasted time, effort and frustration among customers.

Our team’s visual designer also uplifted the iconography and overall visual design of these screens.

Informing customers about their spending to facilitate behaviour change was one of our the three key strategies we implemented to drive financial wellbeing. The strategies included 1) informing customers, 2) intervening or providing friction and 3) automating tasks to reduce cognitive load and drive outcomes.

Financial health checks in branch + Financial hardship contact centre

Dean was heavily involved in a project to design in branch financial health checks for customers to help them understand their finances and ways to save.

Dean was also involved in the design of a system to help Financial hardship contact centre employees assist customers in need.

The in branch health checks was highly successful in terms of perceived value from customers and brand perceptions.

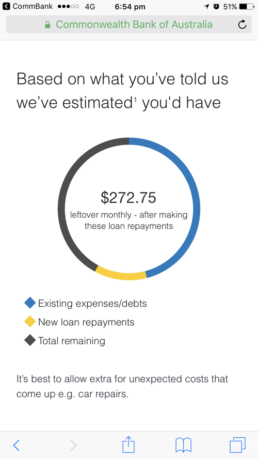

Personal loan applications

Redesign of the Personal loan application form had a very strong customer financial wellbeing focus to help ensure customers did not end up in financial hardship.

Strategic project

Dean was involved in a strategic project to reimagine services CommBank could provide to customers.

The project focussed on how the group could address 4 major health and social issues given the bank reaches nearly 10 million customers.

This purposeful design was an example of how organisations can engage customers on a deeper, less transactional level and have real social impact.

The project is still in progress.

Approach & activities

Discovery

Discovery

• Stakeholder interviews to understand business objectives

• Adobe Analytics analysis to identify drop out points (Quant)

• Competitor analysis

• Customer needs analysis

Usability testing

• Contributed designs into cadence testing with customers to identify any usability issues and iteration until any issues were addressed

Design

• Collaborative design + Design sprints with scrum team

Post-implementation reviews

• Worked closely with sales optimisation managers and stakeholders to understand how the design was performing, including sales uplift and customer wellbeing