CBA Account Application Experience

Overview

CommBank is Australia’s largest bank and has progressed to be at the forefront of user-centred design internationally.

I was UX design lead and the bank enabled us to implement genuine customer-centred design to achieve excellence in the experience of opening bank accounts.

Our work smashed business targets and helped drive the bank to a clear leadership position.

Dean was UX Lead on a number of digital origination product journeys when we were creating the template for these journeys.Inga Latham

– CPO at SiteMinder (formerly Head of UX at CommBank)

My Role

Dean was UX Design lead on many projects during the 5+ years with the bank, including:

Savings and transaction account origination

(core products for the bank)

Personal loan origination

Term deposit origination

Self Managed Super Fund origination

Strategic Projects

Origination Guild to optimise UX design results

Context and objectives

Commonwealth bank sought to significantly grow the number of new customers, retain existing customers and engage them in further business.

The bank also sought to improve the financial wellbeing of customers, particularly in light of greater regulatory scrutiny.

Business case targets for Transaction and savings accounts and personal loans was double digit growth in acquisition.

Technical context of the projects was that CommBank was moving to create APIs to deliver modern UX design working with many backend and legacy systems.

The Transaction account and personal loans projects showed how we could ude the APIs to write data to CommSee to record key information such as loan purpose and customer financial details to support decisioning.

Results

Savings and Transaction accounts

High double digit growth in sales which were unprecedented in the bank and far exceeded business case targets for customer engagement and sales.

This product is the most important onramp for the bank and of key strategic importance to enable deepening and braodening the relationship with other products.

These results led to further investment in growing the UX team as the bank could see the potential of our contribution.

Personal Loans

High double-digit growth in sales but with a focus on customer wellbeing and resilience.

The results for customer engagement and conversion were 2.5 times more than business case targets, whcih was very pleasing to senior stakeholders.

Term Deposits

Significant growth in Term Deposit renewals which stakeholders were extremely pleased with.

The story in images

Transaction and Savings account acquisition UX

Dean led UX for redesign of the bank’s core account product application.

We worked with the research team to understand customer needs, pain points and opportunities and journey mapping to drive design.

The organisation adopted agile during this project and it was the first to do so in the main part of the bank.

We ran design jams with the whole team including stakeholders, UX, visual design, copy, researchers, developers, BAs and testers.

We were early adopters of conversational UX and explored ways to achieve this in ways that would work well as responsive design.

We built a close partnership between stakeholders, UX, copy, visual design UX research and the scrum team to design a form that made it easy and engaging for customers to apply for a new account.

The application had an easy on ramp and push button entries where possible to take the effort out of what would otherwise be a boring form.

We incorporated images and gave reasons why we were asking questions to attract customers to complete more of the form.

The form delivered the highest rate of conversion and lowest rate of drop out in the bank’s history by a significant margin.

We found that framing the question about paperless statements in this way alongside the tree led to a significant uptake in paperless statements.

My hypothesis is that people saw the old tree and felt responsible for killing trees and this influenced them to go with paperless statements.

Personal loan application

We kicked off Discovery with detailed analysis of sales data (including drop off points), customer needs research.

We also fleshed out journey maps for various scenarios and customer profiles.

From the outset we made customer financial wellbeing a priority on the project, exploring various ways to help ensure customers could enter their financial details accurately and they could afford the loan repayments.

We also worked closely with accessibility specialists within the bank.

We tested rough wireframe design concepts to ensure they were clear and easy to use.

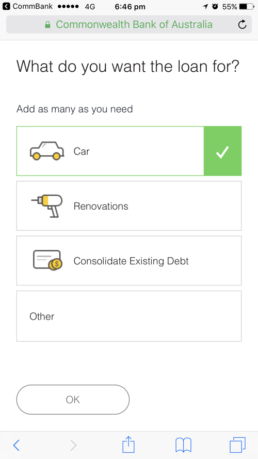

As we progressed the design of the personal loan application we made the application form even more ‘push button’ with big friendly buttons.

We focussed on making tasks as easy and fast as possible, focussing on the needs that data suggested were the most common loan purposes.

I worked closely with stakeholders, sales optimisation managers, solution architects, accessibility specialists, visual designers and developers to make the project successful.

I pushed for a strong focus on customer financial wellbeing from the inception of the project, even before the financial wellbeing team was established.

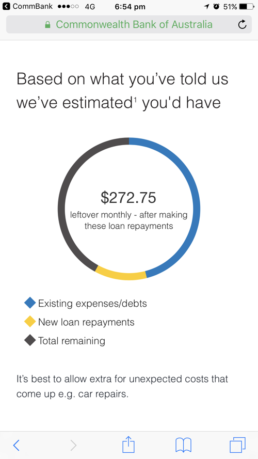

I did all I could to ensure customers we helped to understand how much they would have left over after loan repayments based on their income and expenses.

We pushed to have income and expenses fed into calculators as people are not good at calculating these. However, this data was not able to be automatically fed into the calculations for how much a customer would have left after loan repayments.

The project helped customers avoid having their credit rating impacted by requesting loan amounts they would not be able to afford.

The received the ‘Best Loan Application Experience’ award the year it was launched and also delivered business outcomes that far exceeded the business case targets.

An important outcome to me was that customer financial wellbeing was integrated into the design process and that stakeholders supported us in doing this.

I monitored the outcomes for customers after launch and collaborated with the financial hardship team to help improve customer wellbeing.

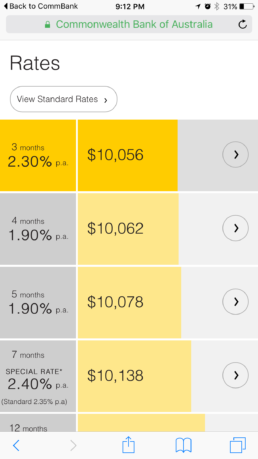

Term Deposit application

Designed the experience for existing customers to get a Term Deposit.

This was one of the first projects where Dean explored visualisation of financial outcomes to help customers make more informed financial decisions.

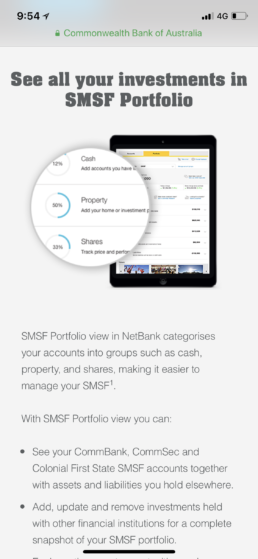

Self Managed Superannuation Fund acquisition

We designed the content and application for customers to set up their Self Managed Super Fund and associated bank accounts.

We helped customers understand features they would be able to access.

All in an application form that was as easy as we could make it with ‘Push button’ entries wherever possible.

Approach & activities

Discovery

• Stakeholder interviews to understand business objectives

• Adobe Analytics analysis to identify drop out points (Quant)

• Competitor analysis

• Customer needs analysis

Design, test and build

• Design sprints including collaborative design with stakeholders, staff, and team

• Evaluated design usability in regular cadence testing with customers to identify and address usability issues

• Quantitative testing via surveys

• Close bonds were built with solution architects and developers to iterate design and bring the vision to life.

Post-implementation

• Worked closely with sales optimisation managers and stakeholders to understand how the design was performing, including sales uplift and customer wellbeing